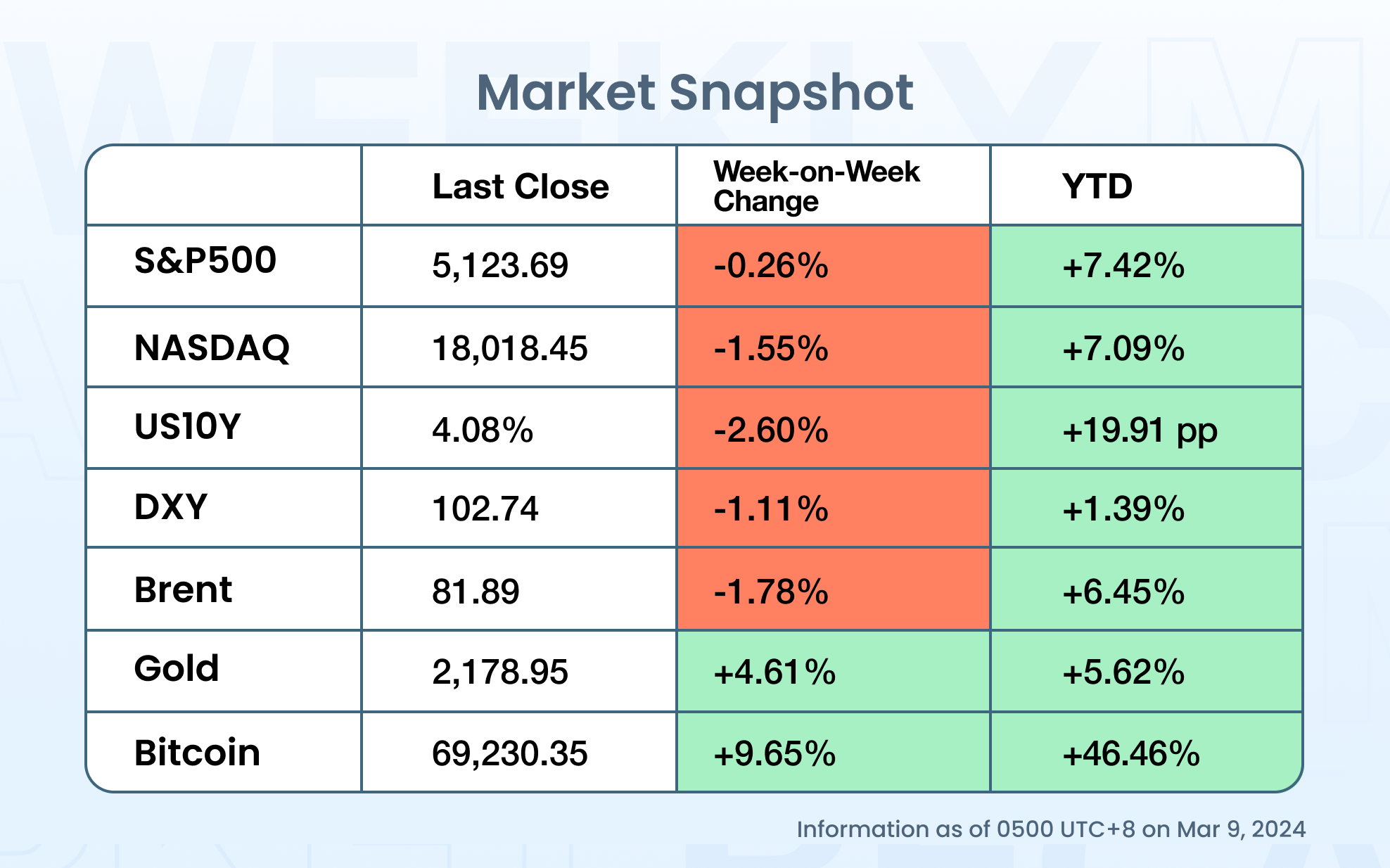

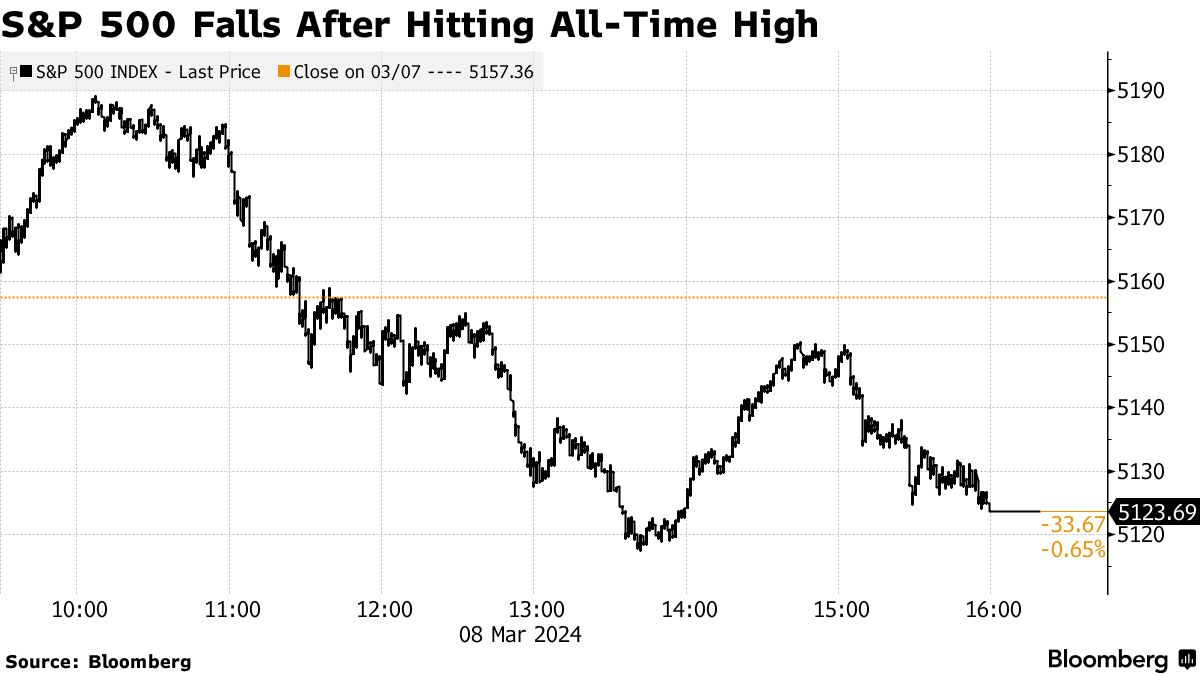

On the back of mixed economic releases, markets continued its grinding ride up over the past week to start the month of March 2024, with the S&P 500 hitting fresh intra-day highs of 5,187 by Friday before finally losing steam and closing at 5,124, and the NASDAQ composite also passed 16,400 on Friday but was dragged down by chip stocks and specifically NVIDIA and Broadcom to close 1.55% down for the week at 16,085.

Friday’s February jobs data came in high at +275,000 NFP (vs 200,000 expected), but countered by a large revision for January data (revised down to 229,000 from 353,000 announced last month). US unemployment ticked up to 3.9% from 3.7% last month, a 2 year high. Markets were pretty unperturbed by the middling jobs data, perhaps giving the bulls some confidence that rate cuts will indeed be starting in the summer.

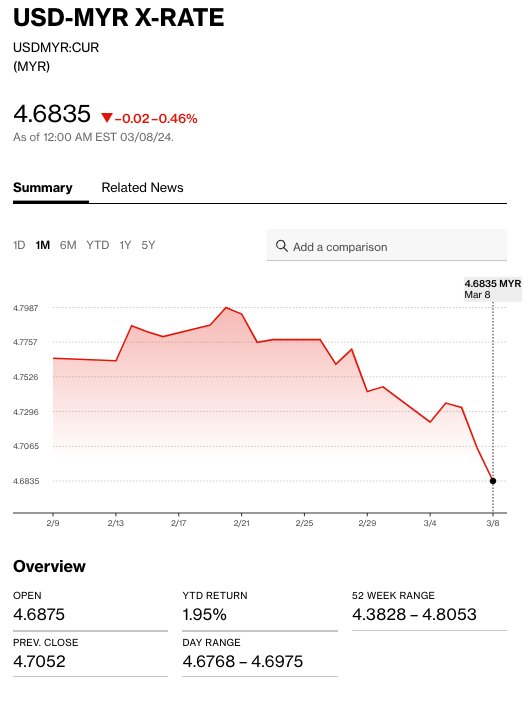

The past week also saw the US dollar continue its downward slide vs most currencies, with the DXY tracing back to its December 2023 / January 2024 lows of 102.7. Particularly sharp was the USDJPY’s slide from the 150.5 levels down to the 147.0 levels to end the week.

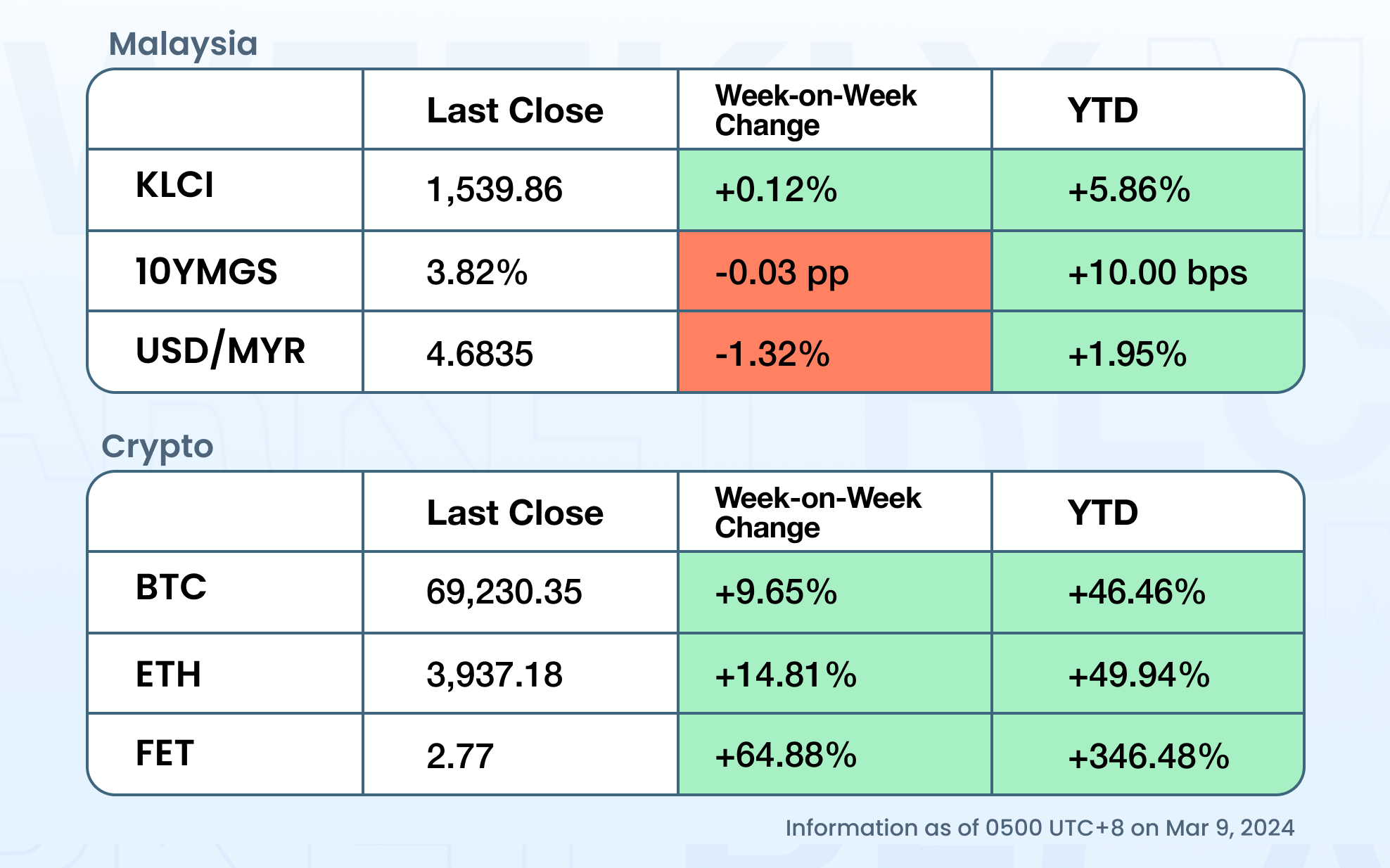

Previously battered Asian currencies saw a similar reprieve this week with the Fed softening their forward guidance on monetary policy (i.e. the direction of interest rates), which saw the ringgit strengthen around 1.3% against the US Dollar.

Meanwhile, Malaysia’s international reserves dropped by 1% to USD114.3bn as of end-Feb. This was expected given some strong resistance at 4.80 for the USDMYR pair and when put into historical context is averaged size depletion. Overall, the reserves position is no cause for alarm especially since USD strength may have peaked.

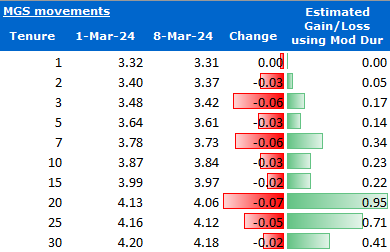

Another beneficiary of this was local bonds. Government bonds saw gains across the curve:

Taking a longer view, yields are generally coming down in Malaysia despite statistics from Bank Negara showing that the bond market experienced 3 consecutive months of outflow (Dec-23, Jan-24, Feb-24). This positioning reflects low inflation (1.5% for a few months now) and potentially weakening growth prospects.

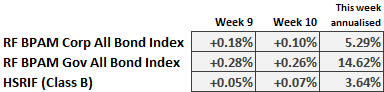

Corporate bonds had a good week but lagged behind their government counterpart. However, this isn’t a bad thing. Spreads were ridiculously tight before (e.g. only 0.08 percentage points of pickup for a government guaranteed bond over its government counterpart) so a bit of spread widening is healthy, even if it is by virtue of government bond yields dropping faster than corporate bond yields:

KLCI remained flat despite foreigners turning net sellers with RM1.6bn worth of outflows for the month-to-date, meaning that local players were happy to support equities at current prices and healthy potential dividend yields (as reported comprehensively by The Edge in their coverage of GLIC earnings in 2023).

As was the theme last week, so it is this week, with the relentless March (pardon the pun) of BTC from the previous week’s $62,000 levels to break through $69,000 on Friday, the all-time high for BTC last seen in November 2021.

This was on the back of sustained net inflows from the 10 BTC ETFs, ranging from $300 - 650m each trading day during the week, translating to somewhere between 5,000 - 10,000 BTCs being purchased from the open market daily.

‘Welcome to crypto’ for all the new ETF holders though. That march upwards was not without some extreme volatility on Tuesday evening (early Wednesday for Asia), with BTC touching $69,000, dropping to $59,000 (-14%) and recovering most of it to $67,500 within a 24 hour period. Into the top, there were signs that a flush was coming - the Crypto Fear Greed Index touched into Extreme Greed territory, and funding rates in Bitcoin perpetual swaps climbed to ~110% p.a. on Binance.

Despite that mid-week swing, BTC prices have continued its grind up to end the week in the $69,000 levels over the weekend after facing resistance at $70,000 on Friday.

That extreme midweek intra-day swing was not limited to BTC but seen across the entire crypto ecosystem, with ETH going from $3,800 to $3,200 and back to $3,800 within 12 hours, SOL going from $140 to $105 and back to $135 within the day, along with most L1s/L2s and memecoins like DOGE, SHIB & PEPE seeing 30-40% swings intraday. Cross liquidations due to margin calls were likely the cause of such extreme swings.

Perhaps amidst all that frenzy, ETH has started to emerge out of it’s bigger BTC brother’s shadow to end the week at a 2 year high touching the elusive $4,000 mark on Friday and to landing at $3,950 levels on the weekend, less than 20% off it’s all time highs in 2021 ($4,868), with the focus finally increasing on it’s own time in the spotlight, Blackrock et al’s ETH ETF applications sitting with the SEC with a May 2024 approval deadline.

On the global front, a few eyes next week on any fallouts from the Bank Term Funding Program (BTFP) facility expiring on Monday 11 March. It seems a long time ago, but casting our minds back to March 2023, US financial markets were on the brink of another (rate-hike-induced) crisis before the Fed stepped in with their 1-year BTFP, now over $160bn in size about to be unwound. Any weaknesses in US regional banks will likely be scrutinised, and any further failures may cascade to the wider markets and cause volatility spikes.

What should investors do when BTC hits its all time high? For long term holders and those with BTC in their portfolios, as we appear to be midway through the BTC bull cycle, no need to panic and take profits at this stage unless you are overexposed, and only then should consider to rebalance.

Watch out for ETH’s potential breakout above $4,000 which could see us rise to $4,200 levels quickly, particularly if the ‘Dencun’ upgrade aiming to increase scalability goes well on Thursday 13 March.

Thank you for reading and we’ll see you next week!